Closing costs for buyers are usually an unavoidable part of buying a home. While there are ways to reduce some closing costs and fees, they are an expense you will likely have to consider when it comes time to save for a home.

On average, buyers can expect to pay between 2 and 5 percent of the purchase price in closing costs and fees.

In this article, we’re going to break down those closing costs and talk about some ways to plan for or limit the fees associated with closing on a home.

A breakdown of closing costs

The buyer pays for most closing costs in a real estate transaction. When getting approved for a mortgage, your lender is required to provide you with an estimate of the closing costs. This is called a “Closing Disclosure Statement,” which overviews your loan details. This document will show your loan terms, costs, and more. It’s very important to review it and ask questions before your closing date so you can come prepared with any funds needing to be paid on closing day. It’s also a good idea to ask how the costs should be paid (certified funds, check, wire transfer, etc.).

Different lenders will charge varying amounts in fees. Some are even willing to waive certain fees. But we’ll discuss that later.

For now, let’s focus on the closing costs buyers typically have to pay:

- Attorney fees – a flat fee or hourly rate depending on the attorney

- Origination fees – an upfront fee charged by the lender for processing your mortgage application

- Prepaid interest or discount points – a payment for the interest that will accrue on your mortgage from the time you close until your first mortgage payment is due

- Home inspection fee – the fee that a professional home inspector charges to inspect a home

- Credit Report fee – a fee the lender charges to check your credit report and score

- Property taxes – usually required to pay six months to a year’s worth of property taxes upfront at closing. This cost may vary depending on the state where the home is located.

- Homeowners Insurance – proof of insurance is required by lenders or you may be required to pay for your first year up front as part of our closing costs

- Flood insurance – if required

- Title search fee – to confirm the property’s rightful legal owner and any claims or liens on that property

- Escrow deposits – Usually split with the seller, this is the fee charged by an escrow agent

- Recording fees – fees for legally recording the new deed and mortgage

- Underwriting fees – fees paid to the lender for researching your mortgage case and determining whether or not to approve your application

These are just some of the many fees that can be due upon closing on a home. Depending on where you live, which lender you choose, and the type of mortgage you secure, your closing costs will vary, so it’s a good idea to shop around for a lender and mortgage type with reasonable closing costs.

Reducing closing costs

Some lenders offer no-cost or low-cost mortgages. However, these savings often come with a higher interest rate which, over the lifespan of your loan, can cost you more in the long run.

You should also be aware of the different loan types you may be eligible for. FHA, USDA, and VA loans are designed for buyers hoping to make lower down payments on their homes.

Each loan type provides different amounts due at closing. Fortunately, your mortgage lender can give you an estimate of the costs for each loan type.

Buyers can also negotiate a seller credit referred to as a “seller concession,” which is money contributed to the buyer from the seller to cover some of the closing costs. This credit is rolled into the home’s sale price, lowering the overall loan cost. Always check with your lender before negotiating an offer that involves a seller’s credit. In some cases, the lender might not allow it.

Want to get an estimate of the closing costs you’ll have to pay when you buy a home? You can use this online calculator to see an average. As this calculator is merely an estimate, it is recommended that you request more accurate and complete title insurance and closing costs quotes from the actual title company and financial institute that you will be using for your transaction.

You can start browsing the MLS homes for sale here.

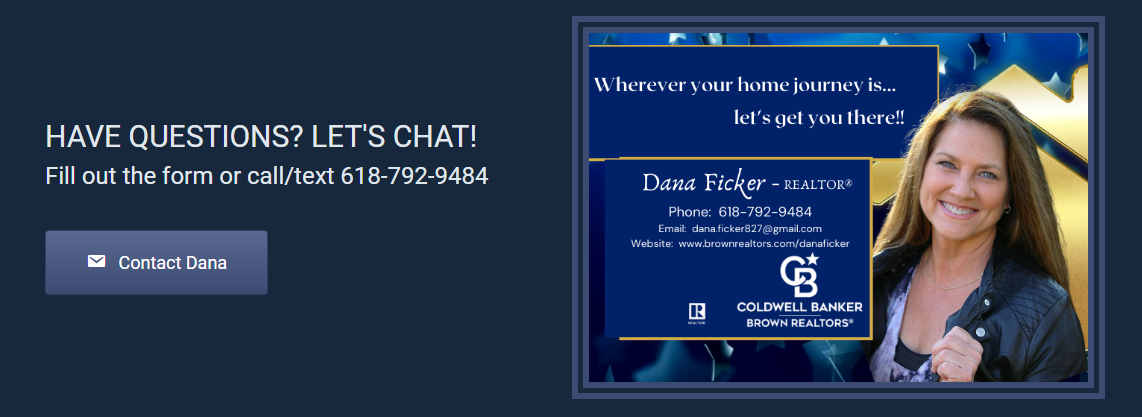

If you are considering buying, reach out via the Contact Dana link for various contact choices or by the form link below.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link